What is Revenue? A Comprehensive Guide to Understanding Business Income and GrowthWhat is Revenue? A Comprehensive Guide to Understanding Business Income and Growth

Revenue is the starting point of business analysis. It measures sales effectiveness and market demand but must be compared with expenses to understand true financial health. To grow a successful company, focus on increasing top-line revenue while managing costs efficiently.

Everything You Need to Know About Revenue

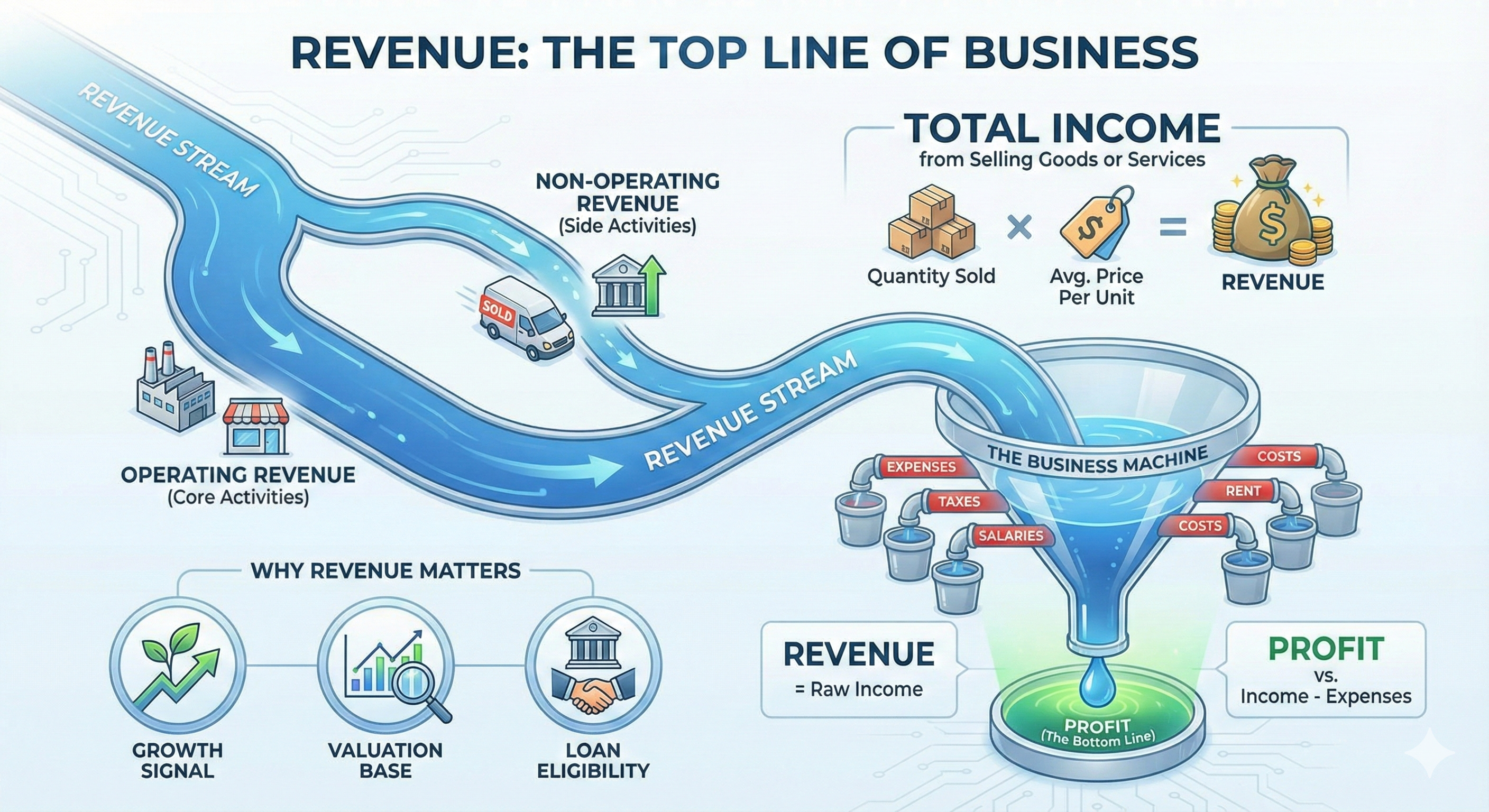

Revenue is the lifeblood of any business. Often called the "top line" because it sits at the very top of an income statement, it represents the total amount of money a company brings in before any expenses are deducted.

Whether you are a small business owner, a student, or an investor, understanding revenue is the first step to financial literacy. This guide breaks down exactly what revenue is, how it differs from profit, and why it matters for global business trends.

What is Revenue?

Simply put, revenue is the total income generated by the sale of goods or services related to the company's primary operations.

For example:

- If a shoe store sells 100 pairs of shoes at $50 each, their revenue is $5,000.

- It does not account for the cost of making the shoes, the rent for the store, or employee salaries.

The Revenue Formula

Calculating revenue is usually straightforward:

Revenue = Quantity of Units Sold x Average Price Per Unit

Revenue vs. Profit: What is the Difference?

This is the most common confusion in finance. While they are related, they tell different stories about a company's health.

- Revenue (The Top Line): The raw income generated from sales. It indicates how well customers are responding to your product.

- Profit (The Bottom Line): The money left over after paying all expenses (taxes, operating costs, debts).

Key Takeaway: A company can have high revenue but low profit if their expenses are too high. Conversely, a company can have lower revenue but high profit if they are extremely efficient.

The Different Types of Revenue

Not all income is the same. Accountants usually categorize revenue into two main buckets to help investors understand where the money is coming from.

1. Operating Revenue

This is money earned from the company's core business activities.

- Example: For Apple, operating revenue comes from selling iPhones and MacBooks.

- Significance: This is the most important metric for long-term sustainability.

2. Non-Operating Revenue

This is money earned from side activities that are unpredictable or one-time events.

- Example: A bakery selling an old delivery van or earning interest on cash sitting in a bank account.

- Significance: While good to have, investors don't rely on this for future growth predictions.

Why is Revenue Important?

Revenue is often used as a key performance indicator (KPI) for several reasons:

- Growth Signal: Consistent revenue growth suggests a company is expanding its market share.

- Valuation: Stock prices and company valuations are frequently based on multiples of revenue (especially for startups that aren't profitable yet).

- Bank Loans: Lenders look at revenue stability to determine if a business can pay back a loan.

Frequently Asked Questions (FAQs)

Q1: Is "Sales" the same thing as "Revenue"?

Yes, in most contexts, the terms are used interchangeably. However, "Revenue" is a broader term that can include income from other sources (like interest), whereas "Sales" strictly refers to money from selling goods.

Q2: Can a company survive without profit if it has revenue?

Short-term, yes. Many startups (like tech companies) focus on growing revenue first and ignore profit for years. However, long-term survival eventually requires the business to become profitable.

Q3: What is "Accrued Revenue"?

This is revenue that has been earned by providing a service, but the cash hasn't been received yet. It is recorded on the books to show that the money is owed to the company.

Q4: What is "Net Revenue"?

Net revenue is the money received after discounts, returns, and allowances are subtracted from the gross revenue. It gives a more accurate picture of actual sales.

Supporting Content: Quick Glossary

Gross Revenue: Total sales before any deductions.

Net Revenue: Gross revenue minus returns and discounts.

Deferred Revenue: Money received in advance for services not yet performed (e.g., an annual subscription paid upfront).

Recurring Revenue: Predictable income that is expected to continue (e.g., Netflix subscriptions).

Conclusion